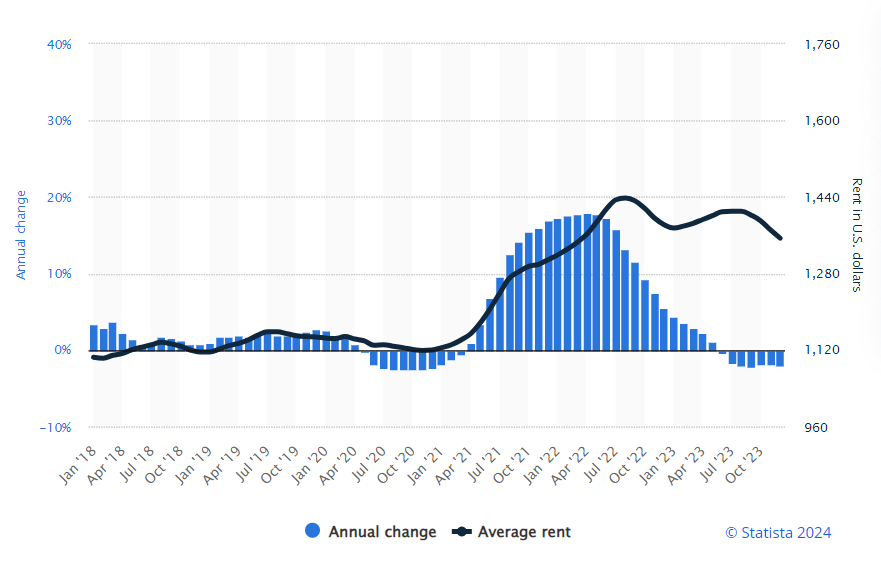

Annual rental growth in Dallas, Texas, from January 2018 to December 2023 Statista

What Caused Rental Rates to Increase in Dallas Ft. Worth?

Multiple factors, such as the pandemic, a shutdown of multifamily construction that led to an even more significant housing shortage, inflation, and a mass migration to Texas from the coastal states, caused rental rates to increase at historic levels. We also believe that the recent adoption of rental pricing software by management companies to price their units using an algorithm similar to how airline and hotel rooms are priced has been the biggest driver of these increases. Currently, there are two class action lawsuits against the software companies and management companies using the software of collusion and other antitrust violations to drive up rental rates, along with an active investigation by Congress.

The Invisible Hand: How Rent Setting Software Has Skyrocketed Rental Rates

In the world of multifamily rentals, technology has emerged as a pivotal factor in driving up rental rates, particularly through rent-setting software. These systems, like RealPage’s YieldStar, employ a proprietary algorithm to influence rental rates, marking a disruptive shift in how prices are determined. Through the aggregation of market data and strategic manipulation of rental competition, such software has become a key player in escalating rental rates throughout Texas, especially in metro areas like DFW, Houston, Austin, and San Antonio, posing challenges to housing affordability.

In 2022, the DallasNews published an article in which multifamily industry executives openly praised this technology for transforming how rental rates are set. “Never before have we seen these numbers,” said Jay Parsons, a vice president of Richardson-based RealPage. Turning to his colleague, Parsons asked: What role had the software played? “I think it’s driving it, quite honestly,” answered Andrew Bowen, another RealPage executive. “As a property manager, very few of us would be willing to actually raise rents double digits within a single month by doing it manually.” In a video testimonial, Kortney Balas, director of revenue management at JVM Realty, said, “The beauty of YieldStar is that it pushes you to go places that you wouldn’t have gone if you weren’t using it.”

Mechanics of Market Manipulation

YieldStar, leveraging its proprietary algorithm, capitalizes on aggregated market data to push for higher rental rates. This practice nudges landlords towards maintaining lower occupancy rates, a strategy poised to inflate rent prices. Such maneuvers not only disrupt rental market dynamics but also edge towards creating scenarios ripe for antitrust violations. The ripple effects on housing affordability and rental competition have drawn intense scrutiny, exposing the underlying tensions between technology in real estate and antitrust laws. The impact has been stark, with rents soaring $300-$500, beyond the reach of a lot of renters.

Now that we’ve given you some background on what we feel has significantly impacted why rental rates have climbed so much in recent years, here are some of our best resources and tips to find a lower-priced apartment.

Resources for Finding an Apartment on a Budget

Privately Owned Rental Properties

Now that you know most professionally managed apartment communities have embraced software to set rental rates, the private rental market is a great place to shop when looking for a budget-friendly rental. It’s not uncommon for properties owned and maintained by an individual to be priced below what a computer algorithm would set as the rental rate.

HAR.com is our top suggestion for finding privately owned rentals for lease. The Houston Association of Realtors operates it and serves all the major metro areas in Texas, including Houston, Dallas, San Antonio, and Austin. Their website gets feeds from the local MLS listing service, and you will be able to find a variety of houses, townhomes, and condominiums for rent.

Facebook Marketplace has probably surpassed Craigslist.com now as the top “green sheet” rental posting service. Here, you will find all types of rentals, including many that are not listed on the local MLS service. The biggest disadvantage is that you will also come across many real estate agents posting available listings to generate leads that they hope will become clients.

Craigslist.com is still a popular place for individual landlords to market their properties for practically free, but it comes with the same advantages and disadvantages as Facebook Marketplace.

Save on Rent With a Roommate

We always recommend that individuals needing help finding an apartment within their budget to consider getting a roommate. Yes, you’ll have to share your living space, but it’s a great way to afford a newly built apartment with all the premium amenities in the area you want to live in. Plus, you may end up making a new friend along the way.

Online Apartment Guides

The most popular is apartments.com, which would also be the site we recommend over the others. The biggest drawback is that many apartments, and even entire management companies, choose not to list their vacant units for rent on these apartment guides. Another thing to be aware of is that when you make an inquiry on their website, you have created a sales lead for their on-site staff, and it’s very likely that you’ll be contacted multiple times.

Use Seasonality to Your Advantage

Last, using the fluctuations in moving activity during different times of the year to your advantage can save you big bucks. Seasonal rent trends are primarily driven by school calendars, the local job market, holidays, and changes in the weather in Texas. Peak leasing season for apartment communities is during the summer months, May through the end of August, when school is out, making moving more manageable for most families. The slowest months of the year are during the winter months, especially during the holidays, October through December. It’s cold, and most people would rather spend that time relaxing with family.

With fewer people looking to move in the wintertime, landlords are more desperate to fill vacancies, leading to rental deals that can feel like hitting the jackpot. It’s the best time of the year to rent if you want to save money. This shift to low demand for apartments not only opens up the door to negotiating better rental agreement terms but also increases the chances of scoring an apartment with more apartment-size options than you’d find in busier seasons.

Also, scheduling movers during the off-peak season is not only cost-effective but also far less stressful. Movers will reduce their rates in the winter months, it’s easier to get your preferred timeslot when demand is lower, and you will also reduce the risk of a rushed, potentially damaging move to your new apartment.